What percentage of the US budget goes to Social Security?

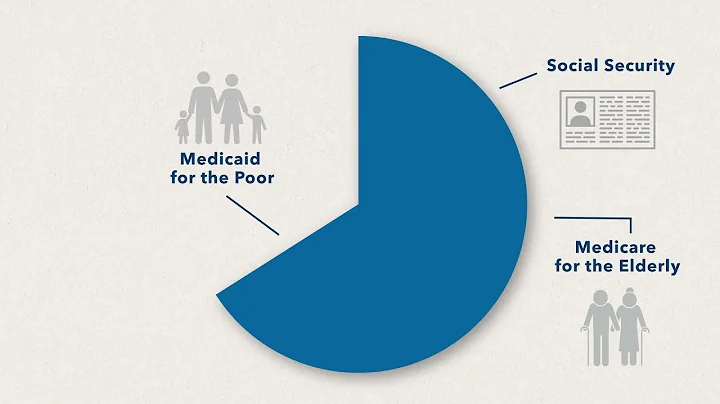

As the chart below shows, three major areas of spending make up the majority of the budget: Social Security: In 2023, 21 percent of the budget, or $1.4 trillion, will be paid for Social Security, which will provide monthly retirement benefits averaging $1,836 to 48.6 million retired workers.

- Social Security ($1,354 billion). ...

- Health ($889 billion). ...

- Medicare ($848 billion). ...

- National Defense ($820 billion). ...

- Income Security ($775 billion). ...

- Net Interest ($658 billion). ...

- Veterans Benefits and Services ($302 billion). ...

- Transportation ($126 billion).

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $168,600 (in 2024), while the self-employed pay 12.4 percent.

The United States' welfare budget totaled $1.101 trillion in fiscal year 2023, or 18% of all federal outlays. Eight different federal agencies run welfare. This analysis pulls information from the agencies to show a combined federal welfare budget. The welfare program listing is shown below.

In fiscal year 2022, the Medicare program cost $747 billion — about 12 percent of total federal government spending.

CBO: U.S. Federal spending and revenue components for fiscal year 2023. Major expenditure categories are healthcare, Social Security, and defense; income and payroll taxes are the primary revenue sources.

| Country/territory | US foreign-owned debt (January 2023) |

|---|---|

| Japan | $1,104,400,000,000 |

| China | $859,400,000,000 |

| United Kingdom | $668,300,000,000 |

| Belgium | $331,100,000,000 |

Social Security can potentially be subject to tax regardless of your age. While you may have heard at some point that Social Security is no longer taxable after 70 or some other age, this isn't the case. In reality, Social Security is taxed at any age if your income exceeds a certain level.

After a Conference which lasted throughout July, the bill was finally passed and sent to President Roosevelt for his signature. The Social Security Act was signed into law by President Roosevelt on August 14, 1935.

How much does the federal government spend on food stamps each year? In fiscal 2022, the government spent $119.4 billion on SNAP. Some $113.9 billion went to benefits while $5.5 billion went to administrative and other expenses.

Which programs get funded the most by the US budget?

Mandatory outlays by the federal government totaled $3.8 trillion in 2023; more than half was for Social Security and Medicare. The largest increases over the past 20 years have been for the major health care programs.

States with the Highest Welfare Recipients:

Based on SNAP data, California leads the pack with a staggering 1,911,000 SNAP households, followed closely by Florida (1,632,000) and Texas (1,595,000).

About one-sixth of federal spending goes to national defense. CBO estimates the budgetary effects of legislation related to national security and assesses the cost-effectiveness of current and proposed defense programs. CBO also analyzes federal programs and issues related to veterans.

| Characteristic | Healthcare** | Military |

|---|---|---|

| United States | 16.6% | 3.45% |

| Germany | 12.7% | 1.39% |

| France | 12.1% | 1.94% |

| Japan | 11.5% | 1.08% |

The U.S. Treasury divides all federal spending into three groups: mandatory spending, discretionary spending and interest on debt. Together, mandatory and discretionary spending account for more than ninety percent of all federal spending, and pay for all of the government services and programs on which we rely.

Mandatory spending is required by laws that Congress has already approved. It makes up the largest component of federal expenditures and is often spent outside of the annual appropriations process, though some mandatory spending accounts are reported in the bills.

Residents in Connecticut, Massachusetts, New Jersey and New York have some of the highest tax bills in the nation. They also pay thousands more in federal taxes than their state receives back in federal funding.

Sources of Federal Revenues

Individual income taxes are the largest single source of federal revenues, constituting nearly one-half of all receipts.

1) Switzerland

It is no surprise to see Switzerland on this list. Switzerland is a country that, in practically all economic and social metrics, is an example to follow. With a population of almost 9 million people, Switzerland has no natural resources of its own, no access to the sea, and virtually no public debt.

Debt as a share of GDP has risen to about the same level as in the United States, while in dollar terms China's total debt ($47.5 trillion) is still markedly below that of the United States (close to $70 trillion). As for non-financial corporate debt, China's 28 percent share is the largest in the world.

What is the most indebted country in the world?

- Japan. Japan has the highest percentage of national debt in the world at 259.43% of its annual GDP. ...

- United States. ...

- China. ...

- Russia.

Have you heard about the Social Security $16,728 yearly bonus? There's really no “bonus” that retirees can collect. The Social Security Administration (SSA) uses a specific formula based on your lifetime earnings to determine your benefit amount.

However, the double-taxation of Social Security benefits can occur at the state level. A grand total of 38 states don't tax Social Security benefits. But if you live in one of the 12 states that do tax Social Security benefits, and earn above the preset income thresholds in those states, double taxation can occur.

According to recently released data from the SSA's Office of the Actuary, just over 590,000 retired-worker beneficiaries were receiving $1,298.26 per month at age 62, as of December 2023. That compares to about 2.11 million aged 66 retired-worker beneficiaries who were taking home $1,739.92 per month.

Yes, it is possible for someone who has never worked or paid into Social Security to receive support in old age if they are unable to work due to disability. In such cases, the individual may be eligible for Supplemental Security Income (SSI) rather than Social Security Disability Insurance (SSDI).

References

- https://finance.yahoo.com/news/10-reasons-claim-social-security-133005765.html

- https://www.cbsnews.com/news/social-security-debt-ceiling-breach-what-happens-to-payments/

- https://www.ssa.gov/history/hfaq.html

- https://www.marketplace.org/2023/05/26/who-does-the-u-s-owe-31-4-trillion/

- https://www.gao.gov/americas-fiscal-future/federal-debt

- https://en.wikipedia.org/wiki/Social_Security_Trust_Fund

- https://www.aarp.org/retirement/social-security/questions-answers/do-identification-numbers-get-reused.html

- https://georgiarecorder.com/2024/03/04/five-months-late-congress-is-poised-to-pass-a-huge-chunk-of-federal-spending/

- https://www.quora.com/Which-president-first-took-money-from-Social-Security

- https://chinapower.csis.org/us-debt/

- https://www.ssa.gov/history/genrev.html

- https://www.cfr.org/backgrounder/us-national-debt-dilemma

- https://www.pbs.org/newshour/politics/how-a-debt-default-could-affect-you

- https://www.investopedia.com/articles/investing/080615/china-owns-us-debt-how-much.asp

- https://www.fidelityinternational.com/editorial/article/how-china-keeps-its-debt-in-order-e1feea-en5/

- https://www.statista.com/statistics/1175077/healthcare-military-percent-gdp-select-countries-worldwide/

- https://finance.yahoo.com/news/top-20-countries-owe-us-175515001.html

- https://www.quora.com/If-China-sells-all-US-treasury-bonds-what-will-happen-to-the-US-economy

- https://www.ssa.gov/newsletter/Statement%20Insert%2025+.pdf

- https://turbotax.intuit.com/tax-tips/retirement/when-does-a-senior-citizen-on-social-security-stop-filing-taxes/L53Hx1v9W

- https://georgewbush-whitehouse.archives.gov/infocus/social-security/youth/

- https://www.aljazeera.com/program/counting-the-cost/2024/2/4/is-chinas-economy-in-serious-trouble

- https://www.marca.com/en/lifestyle/us-news/personal-finance/2023/12/10/6575faeb22601d2a708b458a.html

- https://www.itsuptous.org/blog/who-does-us-owe-money-to

- https://fortune.com/recommends/credit-cards/average-credit-card-debt/

- https://www.ssa.gov/pubs/EN-05-10069.pdf

- https://www.pgpf.org/budget-basics/medicare

- https://www.cbpp.org/research/policy-basics-understanding-the-social-security-trust-funds

- https://cqpress.sagepub.com/cqresearcher/report/french-debt-united-states-cqresrre1925061700

- https://research-center.amundi.com/article/can-us-sustain-rising-debt-burden

- https://www.justfacts.com/nationaldebt.asp

- https://www.marketplace.org/2023/11/07/why-is-china-selling-off-its-us-debt-treasurys/

- https://www.imf.org/en/Publications/fandd/issues/2023/12/China-bumpy-path-Eswar-Prasad

- https://www.cbpp.org/blog/social-security-is-not-bankrupt

- https://www.businessinsider.com/personal-finance/average-american-debt

- https://fiscaldata.treasury.gov/americas-finance-guide/national-deficit/

- https://www.fool.com/retirement/2019/01/20/is-my-social-security-income-being-taxed-twice.aspx

- https://www.cbo.gov/topics/defense-and-national-security

- https://www.taxpolicycenter.org/taxvox/lifetime-social-security-benefits-and-taxes-2023-update

- https://meetbeagle.com/resources/post/which-presidents-borrowed-from-the-social-security-fund

- https://www.quora.com/If-someone-has-never-paid-into-social-security-can-they-collect-benefits-after-they-retire

- https://en.wikipedia.org/wiki/Government_spending_in_the_United_States

- https://www.nationalpriorities.org/budget-basics/federal-budget-101/spending/

- https://www.nasdaq.com/articles/are-social-security-benefits-double-taxed-the-answer-isnt-as-simple-as-you-think

- https://www.ssa.gov/history/InternetMyths2.html

- https://www.pewresearch.org/short-reads/2023/07/19/what-the-data-says-about-food-stamps-in-the-u-s/

- https://www.nasdaq.com/articles/social-security:-is-the-$16728-yearly-bonus-real

- https://www.quora.com/What-would-happen-if-the-USA-and-other-countries-stopped-trading-with-China

- https://www.pgpf.org/blog/2023/05/the-federal-government-has-borrowed-trillions-but-who-owns-all-that-debt

- https://www.ssa.gov/history/1930.html

- https://www.cnbc.com/select/will-social-security-run-out-heres-what-you-need-to-know/

- https://usafacts.org/articles/which-countries-own-the-most-us-debt/

- https://www.investopedia.com/top-10-asian-american-owned-banks-5079644

- https://www.statista.com/statistics/203064/national-debt-of-the-united-states-per-capita/

- https://www.investopedia.com/average-credit-scores-by-gender-5214525

- https://www.investopedia.com/articles/retirement/011317/how-have-comfortable-retirement-social-security-alone.asp

- https://www.ssa.gov/oact/progdata/fundFAQ.html

- https://www.pgpf.org/finding-solutions/understanding-the-budget/revenues

- https://www.forbes.com/advisor/banking/living-paycheck-to-paycheck-statistics-2024/

- https://www.forbes.com/advisor/retirement/debt-ceiling-impact-social-security/

- https://www.pgpf.org/budget-basics/top-10-largest-budget-functions

- https://www.cbo.gov/publication/most-recent/graphics

- https://www.ssa.gov/history/tftable.html

- https://en.wikipedia.org/wiki/Financial_position_of_the_United_States

- https://www.forbesindia.com/article/explainers/top-10-largest-economies-in-the-world/86159/1

- https://www.ssa.gov/history/briefhistory3.html

- https://www.investopedia.com/ask/answers/071514/why-social-security-running-out-money.asp

- https://www.ssa.gov/news/press/factsheets/WhatAreTheTrust.htm

- https://www.governing.com/archive/gov-taxpayers-10-states-give-more-feds-than-get-back.html

- https://www.ceicdata.com/en/indicator/russia/national-government-debt

- https://www.linkedin.com/pulse/who-going-buy-all-us-debt-rod-khleif-gdete

- https://www.investopedia.com/will-millennials-get-social-security-8578850

- https://www.aarp.org/money/investing/info-2018/seniors-before-social-security.html

- https://meetbeagle.com/resources/post/which-party-created-social-security

- https://www.imf.org/en/Blogs/Articles/2023/09/13/global-debt-is-returning-to-its-rising-trend

- http://www.cadtm.org/spip.php?page=imprimer&id_article=13550

- https://www.ssa.gov/policy/docs/ssb/v82n3/v82n3p1.html

- https://www.clearfinances.net/countries-without-public-debt/

- https://www.ssa.gov/policy/docs/ssb/v70n3/v70n3p111.html

- https://www.nasdaq.com/articles/how-much-money-has-congress-taken-social-security-2019-02-04

- https://worldpopulationreview.com/country-rankings/countries-by-national-debt

- https://finance.yahoo.com/news/social-security-16-728-yearly-155211996.html

- https://www.ssa.gov/policy/docs/ssb/v49n10/v49n10p24.pdf

- https://www.investopedia.com/ask/answers/102814/what-maximum-i-can-receive-my-social-security-retirement-benefit.asp

- https://en.wikipedia.org/wiki/Ronald_Reagan_Speaks_Out_Against_Socialized_Medicine

- https://www.investopedia.com/financial-edge/0611/june-20-5-ways-the-u.s.-can-get-out-of-debt.aspx

- https://blog.knowbe4.com/1170-is-how-much-youre-worth-on-the-dark-web

- https://www.ssa.gov/oact/progdata/assets.html

- https://federalsafetynet.com/welfare-budget/

- https://www.investopedia.com/articles/economics/11/successful-ways-government-reduces-debt.asp

- https://www.quora.com/Does-Russia-currently-hold-any-debt-or-loans-from-the-United-States

- https://en.wikipedia.org/wiki/Social_Security_debate_in_the_United_States

- https://www.quora.com/How-much-does-America-owe-to-other-countries-and-how-much-do-those-countries-owe-America

- https://www.verifythis.com/article/news/verify/social-security-verify/how-government-borrows-social-security-trust-funds/536-7f91dc65-145b-4241-a004-510b6b39ba5c

- https://unacademy.com/content/general-awareness/list-of-richest-countries-in-the-world-2022-check-the-net-worth-of-the-us-china-india-uk-canada-japan-and-more/

- https://www.bankrate.com/banking/savings/emergency-savings-report/

- https://www.bankrate.com/retirement/average-monthly-social-security-check/

- https://www.ssa.gov/history/taxationofbenefits.html

- https://wallethub.com/answers/cc/what-percentage-of-america-is-debt-free-2140664784/

- https://www.fool.com/retirement/2024/02/10/heres-average-social-security-benefit-at-age-62-66/

- https://www.ssa.gov/news/press/factsheets/HowAreSocialSecurity.htm

- https://www.forbes.com/advisor/credit-cards/average-credit-card-debt/

- https://thehill.com/opinion/international/4075341-china-is-in-default-on-a-trillion-dollars-in-debt-to-us-bondholders-will-the-us-force-repayment/