How do you declare dividends in accounting?

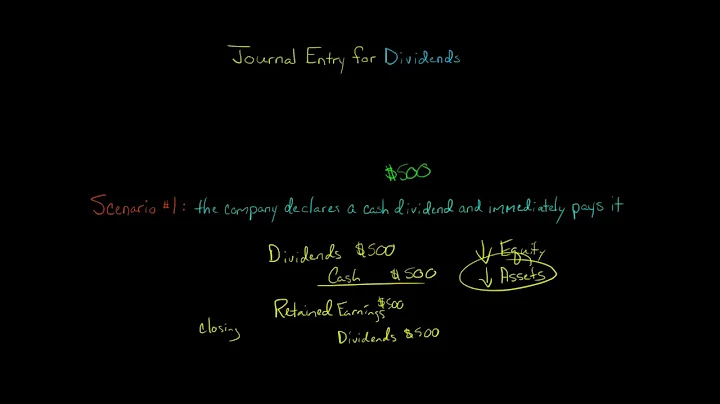

To record a dividend, a reporting entity should debit retained earnings (or any other appropriate capital account from which the dividend will be paid) and credit dividends payable on the declaration date.

Dividends Declared Journal Entry

Dividends are paid out of the company's retained earnings, so the journal entry would be a debit to retained earnings and a credit to dividend payable. It is important to realize that the actual cash outflow doesn't occur until the payment date.

(1) The company may by ordinary resolution declare dividends, and the directors may decide to pay interim dividends. (2) A dividend must not be declared unless the directors have made a recommendation as to its amount.

Accounting for dividends is a relatively simple process. In the case of publicly-traded security, dividends are reported on the income statement in the "distributions to shareholders" account. This account records all dividends paid by the company to its stockholders during a given period.

A common stock dividend distributable appears in the shareholders' equity section of a balance sheet, whereas cash dividends distributable appear in the liabilities section.

Balance Sheet: Dividends paid reduce the “Retained Earnings” account under the “Equity” section. When dividends are declared but not yet paid, they may appear as a “Dividends Payable” under “Current Liabilities.”

So, when dividend is received by X, the double entry is firstly Dr Cash; Cr Dividend (other income), and at the end of year it will be Dr Dividend; Cr Retaining Earnings? 2. If Company M issues shares, it will get the money in return from the investors (who paid for the shares).

There are three prerequisites to paying a cash dividend: a decision by the board of directors, sufficient cash, and sufficient retained earnings.

Click the "Account" button, and then click "New." Click the "Type" field and select "Other Current Liability." Enter "Provision for Dividend" in the Name field. Repeat steps 2-3 to create a "Dividends Payable" account as an Other Current Liability. Create an Expense account called "Dividend Expense."

The total lamount of dividends paid during a period is shown on the Profit and Loss Statement for that period, since they are paid before the calculation of the Retained Profit. Since a P&L Statement is for a period, then all items on it should start at zero again for the next period.

Does declaring a dividend require a journal entry?

On the day the board of directors votes to declare a cash dividend, a journal entry is required to record the declaration as a liability.

If you receive over $1,500 of taxable ordinary dividends, you must report these dividends on Schedule B (Form 1040), Interest and Ordinary Dividends. If you receive dividends in significant amounts, you may be subject to the Net Investment Income Tax (NIIT) and may have to pay estimated tax to avoid a penalty.

Key Takeaways. All dividends paid to shareholders must be included on their gross income, but qualified dividends will get more favorable tax treatment.

Dividend Declared Vs Dividend Paid

The accounting effect of the dividend is retained, the earnings balance of the company is reduced, and a temporary liability account of the same amount is created called “dividends payable.” The dividend paid is the event when the dividends hit the investor's account.

An accrued dividend—also known as dividends payable—are dividends on a common stock that have been declared by a company but have not yet been paid to shareholders. A company will book its accrued dividends as a balance sheet liability from the declaration date until the dividend is paid to shareholders.

Reporting entities often declare dividends on common stock before the balance sheet date, and then pay the dividends after the balance sheet date. Unpaid declared dividends other than stock dividends should be presented as current liabilities.

If dividends are to be paid, a company will declare the amount of the dividend and all relevant dates. Then, all holders of the stock (by the ex-date) will be paid accordingly on the upcoming payment date. Investors who receive dividends can choose to take them as cash or as additional shares.

If a company no longer has any retained earnings on its balance sheet, then it typically can't pay dividends except in extraordinary circ*mstances. Retained earnings represent the accumulated earnings from a company since its formation.

When the dividends are paid, the effect on the balance sheet is a decrease in the company's retained earnings and its cash balance. In other words, retained earnings and cash are reduced by the total value of the dividend.

Cash or stock dividends distributed to shareholders are not recorded as an expense on a company's income statement. Stock and cash dividends do not affect a company's net income or profit. Instead, dividends impact the shareholders' equity section of the balance sheet.

Which account is credited when a dividend is declared?

dividend and dividend payable. This is the correct alternative. The dividends contra-equity account is debited because dividends eventually decrease Retained Earnings, and the dividend payable current liability is credited because it increases on the date dividends are declared.

When a stock dividend is declared, the amount to be debited is calculated by multiplying the current stock price by shares outstanding by the dividend percentage. When paid, the stock dividend amount reduces retained earnings and increases the common stock account.

Investors pay taxes on the dividend the year it is announced, not the year they are paid the dividend.

How do dividends impact cash flow? Because dividends are considered a liability, rather than an asset, they won't influence your business's cash flow until the dividends are issued. Here's how the process works in a little more detail: Dividends are announced by the directors of the company.

The closing entry will credit Dividends and debit Retained Earnings.

References

- https://oer.pressbooks.pub/utsaccounting2/chapter/record-transactions-and-the-effects-on-financial-statements-for-cash-dividends-property-dividends-stock-dividends-and-stock-splits/

- https://courses.lumenlearning.com/wm-financialaccounting/chapter/dividends/

- https://www.taxinsider.co.uk/dividend-payments-practical-issues-and-pitfalls-ta

- https://www.investsmart.com.au/investment-news/whats-the-difference-between-dividends-and-distributions/152895

- https://www.investopedia.com/terms/a/accrued-dividend.asp

- https://www.investopedia.com/ask/answers/090415/are-dividends-considered-expense.asp

- https://viewpoint.pwc.com/dt/us/en/pwc/accounting_guides/financing_transactio/financing_transactio_US/chapter_4_common_sto_US/44_dividends_US.html

- https://www.collinsdictionary.com/sentences/english/dividend

- https://www.citizensbank.com/learning/understanding-dividends.aspx

- https://www.investopedia.com/ask/answers/090415/who-actually-declares-dividend.asp

- https://quod.lib.umich.edu/m/middle-english-dictionary/dictionary/MED12249

- https://finance.yahoo.com/news/much-money-live-entirely-off-204845865.html

- https://www.universalcpareview.com/ask-joey/what-is-the-journal-entry-to-record-a-dividend-payable/

- https://www.superfastcpa.com/where-do-dividends-appear-in-the-financial-statements/

- https://www.investopedia.com/ask/answers/082316/are-qualified-dividends-included-gross-income.asp

- https://www.irs.gov/faqs/interest-dividends-other-types-of-income/1099-div-dividend-income/1099-div-dividend-income

- https://www.icsi.edu/media/portals/86/Geeta_Saar_74_Punishment_for_failure_to_distribute_dividends.pdf

- https://smsfwarehouse.com.au/services/tax/dividend-stripping/

- https://www.nerdwallet.com/article/investing/what-are-dividends

- https://www.cnbc.com/select/what-are-dividends/

- https://www.vintti.com/blog/how-to-calculate-dividend-payouts-in-quickbooks/

- https://corporatefinanceinstitute.com/resources/accounting/dividend/

- https://www.quora.com/How-do-dividend-payments-differ-from-profit-sharing

- https://www.ato.gov.au/forms-and-instructions/you-and-your-shares-2023/dividends-distributions-and-tax-on-amounts-you-receive/dividend-or-distribution-statement

- https://www.marketwatch.com/guides/insurance-services/dividend-life-insurance/

- https://www.irs.gov/faqs/interest-dividends-other-types-of-income/1099-div-dividend-income

- https://www.cfainstitute.org/en/membership/professional-development/refresher-readings/understanding-income-statements

- https://www.deskera.com/blog/accounting-for-dividends/

- https://www.quora.com/Can-a-company-pay-dividends-regularly-but-have-no-profit-at-all-growth-vs-value

- https://psu.pb.unizin.org/acctg211/chapter/closing-entries/

- https://www.suredividend.com/dividend-payment-process/

- https://www.fool.com/knowledge-center/can-dividends-be-paid-in-excess-of-retained-earnin.aspx

- https://www.investopedia.com/ask/answers/102714/how-and-when-are-stock-dividends-paid-out.asp

- https://www.tipranks.com/glossary/e/earnings-per-share

- https://www.apartmentlist.com/renter-life/proof-of-income

- https://byjus.com/maths/dividend/

- https://www.law.cornell.edu/wex/dividend

- https://www.irs.gov/taxtopics/tc404

- https://en.adgm.thomsonreuters.com/rulebook/30-procedure-declaring-dividends

- https://www.nerdwallet.com/article/taxes/dividend-tax-rate

- https://homework.study.com/explanation/when-a-dividend-is-declared-the-accounts-debited-and-credited-are-a-dividend-and-dividend-payable-b-dividend-payable-and-cash-in-bank-c-retained-earnings-and-dividends-d-cash-and-dividend-payable.html

- https://www.thriventfunds.com/support/tax-resource-center/dividends-and-capital-gain-distributions-faqs.html

- https://viewpoint.pwc.com/dt/us/en/pwc/accounting_guides/financial_statement_/financial_statement___18_US/chapter_5_stockholde_US/511_dividends_US.html

- https://www.businessinsider.com/personal-finance/how-dividends-are-taxed

- https://www.investopedia.com/articles/investing/030416/3-tax-implications-dividend-stocks.asp

- https://ludwig.guru/s/a+one-sentence+answer

- https://opentuition.com/topic/double-entries-for-dividends-paid/

- https://www.investopedia.com/ask/answers/090415/do-dividends-go-balance-sheet.asp

- https://www.vocabulary.com/dictionary/divisive

- https://www.investopedia.com/terms/d/dividendpolicy.asp

- https://www.theaccountancy.co.uk/limited-company/dividends/how-often-can-i-take-dividends-from-my-limited-company-90705.html

- https://turbotax.intuit.com/tax-tips/investments-and-taxes/guide-to-taxes-on-dividends/L1jBC5OvB

- https://smartasset.com/taxes/how-do-i-avoid-paying-tax-on-dividends

- https://www.hrblock.com/tax-center/irs/audits-and-tax-notices/tax-dictionary-form-1099-div-dividends-distributions/

- https://economictimes.indiatimes.com/definition/dividend

- https://www.wolterskluwer.com/en/expert-insights/ten-differences-llcs-or-corporations-consider-nontax-differences

- https://turbotax.intuit.com/tax-tips/investments-and-taxes/what-is-irs-form-1099-div-dividends-and-distributions/L8tWOrCJV

- https://www.merriam-webster.com/dictionary/share

- https://www.investopedia.com/terms/d/dividend.asp

- https://www.dummies.com/article/business-careers-money/personal-finance/investing/investment-vehicles/dividends/how-dividends-work-170783/

- https://www.listonnewton.com.au/information-centre/paying-dividends-from-private-companies

- https://www.investopedia.com/terms/s/spillover_dividend.asp

- https://www.cliffsnotes.com/study-guides/accounting/accounting-principles-ii/corporations/dividends

- https://www.book-keepers.org.uk/t48709447/dividends-on-limited-company-balance-sheet-question/

- https://www.albert.io/blog/simple-sentences/

- https://www.collinsdictionary.com/us/dictionary/english/discordant

- https://www.splashlearn.com/math-vocabulary/division/dividend

- https://study.com/academy/lesson/impact-of-dividend-distribution-on-retained-earnings.html

- https://www.acapam.com/diversification/3-dates-to-remember-if-you-want-a-cash-dividend/

- https://uk.practicallaw.thomsonreuters.com/w-041-6006?transitionType=Default&contextData=(sc.Default)

- https://www.ftb.ca.gov/file/personal/income-types/information-returns-1099.html

- https://www.fool.com/knowledge-center/where-is-common-stock-dividend-distributable-on-a.aspx

- https://www.investopedia.com/ask/answers/090415/how-do-dividends-affect-balance-sheet.asp

- https://study.com/learn/lesson/dividend-overview-examples.html

- https://www.linkedin.com/pulse/declaration-dividend-accordance-companies-act

- https://www.bajajfinserv.in/dividend-yield

- https://www.forbes.com/advisor/investing/dividend-yield/

- https://corporate.cyrilamarchandblogs.com/2024/01/declaration-of-dividend-interplay-of-law-and-business-dynamics/

- https://www.accountingtools.com/articles/does-a-dividend-reduce-profit.html

- https://refi.com/additional-forms-of-income-for-mortgage/

- https://www.bartermckellar.law/corporate-law-explained/maximizing-returns-understanding-dividends-and-distribution-rights-in-south-african-law

- https://www.investopedia.com/ask/answers/091115/are-dividends-considered-asset.asp

- https://www.informdirect.co.uk/shares/when-can-company-pay-dividend/

- https://www.investopedia.com/articles/03/011703.asp

- https://www.accountingtools.com/articles/are-dividends-considered-an-expense.html

- https://www.superfastcpa.com/are-dividends-considered-an-expense/

- https://thirdspacelearning.com/blog/what-is-division/

- https://www.wallstreetmojo.com/dividend-declared/

- https://www.ml.com/articles/what-dividend-stocks-can-offer.html

- https://sentence.yourdictionary.com/dividend

- https://www.investopedia.com/terms/q/qualifieddividend.asp

- https://brainly.in/question/27295066

- https://www.investopedia.com/terms/r/retainedearnings.asp

- https://investor.vanguard.com/investor-resources-education/taxes/form-1099-div

- https://www.wallstreetprep.com/knowledge/dividends-payable/

- https://gocardless.com/guides/posts/dividends-cash-flow-statement/

- https://turbotax.intuit.com/tax-tips/investments-and-taxes/what-is-a-schedule-b-irs-form/L9G2RijlF

- https://www.cuemath.com/numbers/dividend/

- https://www.icsi.edu/media/webmodules/Guidance_Note_on_Dividend_.pdf

- https://www.investopedia.com/ask/answers/011215/if-i-reinvest-my-dividends-are-they-still-taxable.asp

- https://www.efile.com/ordinary-qualified-dividends-tax-rates-stock-income/

- https://approved-accounting.co.uk/blog/how-do-dividends-work-in-a-small-business/