How do non depository institutions make money?

Answer and Explanation: Role of non-depository financial institutions: Generate funds other than deposits: For financing companies, non-depository financial institutions generate funds by issuing securities and then lend this fund to sole proprietors and small companies.

Non-deposit financial institutions earn their money by selling securities (bonds, notes, stock or shares) as well as insurance policies. Life insurance companies, investment companies, and consumer finance companies are three common non-deposit financial institutions.

Where do non-bank lenders get their money? Non-bank lenders need funds to lend to borrowers, which they can raise in a few different ways. These include market-based finance, securitisation and through investors who provide peer-to-peer funding.

Non-depository institutions are an essential part of the financial system. They facilitate various financial activities without accepting deposits. These institutions come in several forms: Insurance Companies: They offer policies to individuals or entities, providing financial protection in exchange for premiums.

Nondeposit funds are obtained by various kinds of borrowing. For instance, a bank may raise money by selling capital notes. As the name indicates, these are notes issued to raise capital, much in the same way that equity capital is raised by issuing bonds. The notes must be paid back within a prescribed time period.

Unbanked individuals are likely using money orders in place of checks and, to some extent, debit cards — 92% say they use them to pay bills. Money orders aren't too pricey, and they're less expensive from a nonbank than a bank, generally speaking.

Nondepository institutions include insurance companies, pension funds, brokerage firms, and finance companies.

Nondepository institutions include insurance companies, pension funds, securities firms, government-sponsored enterprises, and finance companies. There are also smaller nondepository institutions, such as pawnshops and venture capital firms, but they are much smaller sources of funds for the economy.

Examples of nonbank financial institutions include insurance firms, venture capitalists, currency exchanges, some microloan organizations, and pawn shops. These non-bank financial institutions provide services that are not necessarily suited to banks, serve as competition to banks, and specialize in sectors or groups.

- Some borrowers may be subject to higher interest rates compared to traditional banks. ...

- There is a troubling lack of regulation compared to traditional banks. ...

- Non bank lenders often have a limited range of financial products compared to traditional banks.

What are 2 types of non depository institutions?

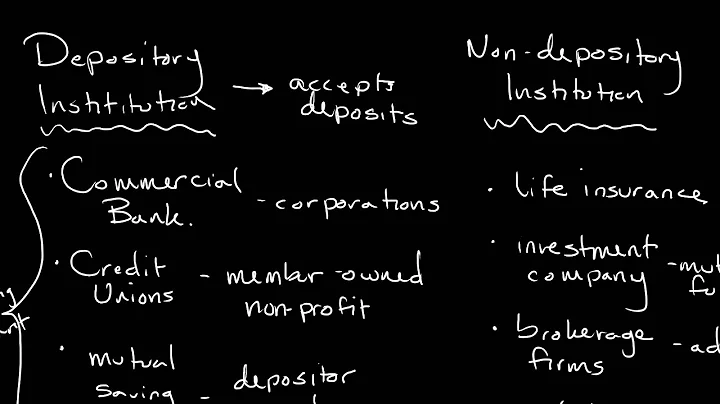

Those that accept deposits from customers—depository institutions—include commercial banks, savings banks, and credit unions; those that don't—nondepository institutions—include finance companies, insurance companies, and brokerage firms.

They are not federally insured and do not accept deposits like depository financial institutions (commercial banks and credit unions). Examples include insurance companies, mutual funds and investment banks.

Depositories serve multiple purposes for the general public. First, they eliminate the owner's risk of holding physical assets by providing a safe place to store them. For instance, banks and other financial institutions give consumers a place to deposit their money by offering time deposit and demand deposit accounts.

A non-depository institution is an entity that does not accept deposits. For example, an established FDIC-insured bank may have a branch or office that only handles commercial lending transactions, and does not accept deposits or disburse funds.

Like banks and thrifts, credit unions are depository institutions that accept deposits and make loans.

NBFCs are not subject to the banking regulations and oversight by federal and state authorities adhered to by traditional banks. Investment banks, mortgage lenders, money market funds, insurance companies, hedge funds, private equity funds, and P2P lenders are all examples of NBFCs.

Being unbanked means things like cashing checks and paying bills are costly and time-consuming. Those who are unbanked often must rely on check cashing services to cash paychecks because they don't have direct deposit.

While the median bank account balance is $8,000, according to the latest SCF data, the average — or mean — balance is actually much higher, at $62,410.

| # | Bank | TCRE to Equity |

|---|---|---|

| 1 | Dime Community Bank | 656.80% |

| 2 | First Foundation Bank | 598.20% |

| 3 | Provident Bank | 546.30% |

| 4 | Valley National Bank | 471.60% |

| Rank by Asset Size | Bank Name | Total Assets |

|---|---|---|

| 1. | Chase Bank | $3.38 trillion |

| 2. | Bank of America | $2.45 trillion |

| 3. | Wells Fargo | $1.7 trillion |

| 4. | Citibank | $1.68 trillion |

What three tools does the Fed use to control the money supply?

The Federal Reserve controls the three tools of monetary policy--open market operations, the discount rate, and reserve requirements.

Pros of credit unions

Credit union profits go back to members, who are shareholders. This enables credit unions to charge lower interest rates on loans, including mortgages, and pay higher yields on savings products, such as share certificates (the credit union equivalent of certificates of deposit).

Answer and Explanation:

Examples of a depository institution are commercial banks, savings banks, and rural banks. Non depository institution - are those financial institutions that do not accept deposit but instead act as intermediaries between the savers and lenders.

There are three major types of depository institutions in the United States. They are commercial banks, thrifts (which include savings and loan associations and savings banks) and credit unions.

Pros of brick-and-mortar banks

Convenience and assurance of personal service and support, including some big banks that offer 24/7 customer service.

References

- https://wallethub.com/edu/cc/pros-and-cons-of-credit-cards/25830

- https://m.economictimes.com/wealth/invest/5-nbfcs-offering-more-than-8-60-fd-interest-rate-for-senior-citizens/articleshow/102898726.cms

- https://www.nerdwallet.com/article/banking/data-unbanked

- https://www.capitalone.com/learn-grow/money-management/which-credit-score-is-most-accurate/

- https://www.investopedia.com/terms/f/financialinstitution.asp

- https://www.southlandcu.org/scu-news/2020/november/10-fun-facts-about-credit-union/

- https://www.paisabazaar.com/fixed-deposit/shriram-city-union-finance-fd-rates/

- https://www.bankatfirst.com/business/resources/commercial/purpose-where-four-cs-credit-worthiness-converge.html

- https://thismatter.com/money/banking/nondepository-institutions.htm

- https://www.bankrate.com/banking/credit-unions/credit-union-pros-and-cons/

- https://www.nerdwallet.com/au/home-loans/non-bank-lenders-explained

- https://www.fdic.gov/resources/deposit-insurance/financial-products-not-insured/

- https://www.confiduss.com/en/info/blog/article/bank-financial-institution-comparison/

- https://www.credit.com/blog/what-types-of-credit-scores-are-there/

- https://www.aba.com/about-us/our-story/aba-history/1782-1799

- https://www.bankrate.com/banking/savings/savings-account-average-balance/

- https://www.bajajfinserv.in/bank-or-nbfc-why-getting-personal-loan-from-nbfc-is-better

- https://www.wintwealth.com/bonds/nbfc-bonds/

- https://portal.ct.gov/DOB/Consumer/Consumer-Education/ABCs-of-Banking--Banks-Thrifts-and-Credit-Unions

- https://www.bajajfinservmarkets.in/fixed-deposit/shriram-finance-fd.html

- https://study.com/academy/lesson/how-money-is-made-understanding-bank-lending-in-the-economy.html

- https://www.studysmarter.co.uk/explanations/macroeconomics/economics-of-money/depository-institutions/

- https://www.forbes.com/advisor/banking/safest-banks-in-the-us/

- https://quizlet.com/43103272/bank-and-credit-union-flash-cards/

- https://www.businessinsider.com/personal-finance/best-banks

- https://www.lloydsbank.com/credit-cards/help-and-guidance/credit-card-numbers-explained.html

- https://kuvera.in/blog/nbfc-fixed-deposits-a-comparison-with-bank-fixed-deposits/

- https://portal.ct.gov/DOB/Consumer/Consumer-Education/ABCs-of-Banking---Banks-and-Our-Economy

- https://dictionary.law.com/Default.aspx?selected=32

- https://smartasset.com/financial-advisor/what-is-a-financial-institution

- https://www.bajajfinserv.in/insights/difference-between-banks-and-nbfc

- https://www.seasonsfcu.org/membership-and-benefits/why-join-us/what-is-a-credit-union-/

- https://byjus.com/ias-questions/who-controls-non-banking-financial-companies/

- https://en.wikipedia.org/wiki/Wells_Fargo

- https://www.marketwatch.com/guides/banking/largest-banks-in-the-us/

- https://www.energy.gov/scep/slsc/financial-institutions

- https://students.austincc.edu/money/types-of-credit/

- https://www.businessinsider.com/28-banks-with-the-highest-commercial-real-estate-risk-2024-3

- https://unacademy.com/content/general-awareness/list-of-top-10-finance-companies-in-india/

- https://www.fdic.gov/regulations/examinations/credit_card/pdf_version/ch2.pdf

- https://www.magicbricks.com/blog/home-loan-from-bank-vs-nbfc/128521.html

- https://www.equifax.com/personal/education/credit-cards/articles/-/learn/how-many-credit-cards-should-i-have/

- https://www.livemint.com/money/personal-finance/these-nbfcs-offer-over-8-interest-rate-on-their-fds-bajaj-finserv-muthoot-fincorp-shriram-finance-mahindra-finance-11707823730871.html

- https://dfpi.ca.gov/commercial-banks/directory-of-state-charted-com-banks/

- https://wallethub.com/answers/cc/is-a-2000-credit-limit-good-2140791827/

- https://www.investopedia.com/terms/d/depository.asp

- https://www.nerdwallet.com/article/small-business/master-the-5-cs-of-credit

- https://www.topuniversities.com/courses/accounting-finance/accounting-vs-finance-which-should-you-study

- https://www.elementfcu.org/why-is-it-called-a-credit-union/

- https://www.investopedia.com/financial-edge/0711/how-many-credit-cards-should-you-have.aspx

- https://www.cnbc.com/select/revolving-credit-vs-installment-credit/

- https://www.fincen.gov/financial-institution-definition

- https://www.indostarhfc.com/blog/5-reasons-to-choose-nbfc-for-home-loan

- https://en.wikipedia.org/wiki/History_of_banking

- https://byjus.com/commerce/functions-of-commercial-banks/

- https://www.cusocal.org/Learn/Financial-Guidance/Blog/Credit-Unions-vs-Banks

- https://homework.study.com/explanation/what-are-the-three-basic-sources-of-economic-profits-classify-the-source-of-economic-profit-in-each-of-the-following-a-a-firm-s-profits-from-developing-and-patenting-a-new-medication-that-improves.html

- https://www.bajajfinserv.in/investments/fixed-deposit

- https://byjus.com/question-answer/identify-the-main-source-of-income-for-banks/

- https://unacademy.com/content/kerala-psc/study-material/science-technology/banking-and-non-banking-financial-institutions/

- https://www.federalreserve.gov/monetarypolicy/fomc.htm

- https://www.sciencedirect.com/topics/economics-econometrics-and-finance/bank-profitability

- https://byjus.com/ias-questions/is-nbfc-business-profitable/

- https://www.usnews.com/banking/articles/credit-union-vs-a-bank

- https://www.bajajfinservmarkets.in/fixed-deposit/safest-bank-in-india.html

- https://corporatefinanceinstitute.com/resources/commercial-lending/types-of-credit/

- https://www.takechargeamerica.org/the-many-downsides-of-being-unbanked/

- https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/nonbank-financial-institution

- https://quizlet.com/491511067/business-management-1-flash-cards/

- https://www.investopedia.com/terms/n/nbfcs.asp

- https://www.experian.com/blogs/ask-experian/why-do-i-have-so-many-credit-scores/

- https://mycreditunion.gov/about-credit-unions/credit-union-different-than-a-bank

- https://time.com/personal-finance/article/types-of-credit/

- https://www.nerdwallet.com/article/credit-cards/types-of-credit-cards

- https://www.bajajfinserv.in/investments/bank-vs-nbfc-fd

- https://wallethub.com/answers/cc/is-1000-credit-limit-good-for-first-credit-card-2140833164/

- https://www.cnbc.com/select/how-to-get-a-good-credit-mix/

- https://study.com/academy/lesson/understanding-debits-and-credits-in-accounting.html

- https://firstutahbank.com/what-is-the-difference-between-banking-and-finance/

- https://www.quora.com/What-is-the-main-difference-between-financial-and-non-financial-company

- https://quizlet.com/134374088/personal-finance-chapter-5-flash-cards/

- https://open.lib.umn.edu/exploringbusiness/chapter/13-2-financial-institutions/

- https://www.bankrate.com/banking/banks-vs-credit-unions/

- https://www.emarketer.com/insights/nonbank-alternative-lending-companies/

- https://www.nelito.com/blog/the-top-10-nbfcs-in-india-2024.html

- https://www.ccu.com/learn/banking-basics/3-benefits-of-a-credit-union/

- https://www.usnews.com/banking/articles/facts-about-credit-unions

- https://www.skywardcu.com/blog/difference-between-share-and-savings-accounts

- https://allincu.com/why-us/our-story.html

- https://www.rbnz.govt.nz/statistics/series/non-banks-and-other-financial-institutions/non-deposit-taking-finance-companies-balance-sheet

- https://fastercapital.com/content/NBFC-vs--Banks--Understanding-the-Key-Differences-and-Similarities.html

- https://www.advantiscu.org/about/why-are-credit-unions-safer-than-banks

- https://www.forbes.com/advisor/banking/difference-between-bank-and-credit-union/

- https://www.quora.com/What-is-the-difference-between-banking-and-a-bank

- https://homework.study.com/explanation/the-primary-assets-of-credit-unions-are-a-municipal-bonds-b-business-loans-c-consumer-loans-d-mortgages.html

- https://www.investopedia.com/terms/b/bank.asp

- https://www.livemint.com/technology/nbfcs-relying-more-on-bank-loans-rbi-11695064531584.html

- https://courses.lumenlearning.com/suny-osintrobus/chapter/u-s-financial-institutions/

- https://www.bankrate.com/banking/savings/online-vs-brick-and-mortar-banks/

- https://brainly.com/question/7718848

- https://www.linkedin.com/pulse/all-you-need-know-funding-nbfc-bizadvisorshq-nny9c

- https://www.creditunion1.org/learn/whats-the-difference-between-a-credit-union-and-a-bank/

- https://www.jpmorganchase.com/about/our-business

- https://vikaspedia.in/social-welfare/financial-inclusion/financial-literacy/non-banking-financial-companies

- https://kids.britannica.com/students/article/bank-and-banking/273096

- https://dfi.wa.gov/financial-education/information/predatory-lending

- https://www.heausa.org/non-bank-lenders-the-pros-and-cons-you-need-to-consider/

- https://www.forbes.com/advisor/banking/largest-banks-in-the-us/

- https://www.jpmorganchase.com/about/our-history

- https://www.rbi.org.in/commonperson/english/scripts/FAQs.aspx?Id=1167

- https://www.tatacapital.com/about-us.html

- https://homework.study.com/explanation/describe-the-characteristics-of-a-credit-union-what-is-the-purpose-function-of-a-credit-union.html

- https://homework.study.com/explanation/what-is-the-difference-between-a-depository-and-a-non-depository-institution.html

- https://cushion.ai/blog/types-of-credit/

- https://home.treasury.gov/system/files/131/Report-Credit-Unions-2001.pdf

- https://www.freescoresandmore.com/credit-bureau-differences.html

- https://www.ocasahomes.co.uk/blog-posts/what-is-a-reduced-deposit-or-no-deposit-option-for-tenants

- https://www.capitalone.com/learn-grow/money-management/three-credit-bureaus/

- http://sonamgeda.com/nbfc-company.php

- https://quizlet.com/553620448/personal-finance-chapter-9-flash-cards/

- https://www.silamoney.com/ach/understanding-non-bank-financial-institutions-what-are-they-how-do-they-work

- https://brainly.com/question/21814202

- https://bfsi.eletsonline.com/elets-top-100-nbfcs-ranking-2023/

- https://mycreditunion.gov/knowledgebase/what-would-fdic-insured-non-depository-be

- https://www.creditkarma.com/credit-cards/i/how-types-credit-affect-score

- https://www.windcave.com/support-merchant-frequently-asked-questions-testing-details

- https://www.nationaldebtrelief.com/blog/financial-wellness/financial-education/revealed-the-downside-of-credit-unions/

- https://www.investopedia.com/financial-edge/1211/6-benefits-of-using-a-credit-union.aspx

- https://quizlet.com/581863624/consumer-ed-unit-6-study-set-flash-cards/

- https://www.forbes.com/advisor/banking/what-is-a-credit-union/

- https://www.samco.in/knowledge-center/articles/nbfc-full-form-history-types-and-the-top-listed-nbfcs-in-india/

- https://study.com/academy/lesson/three-cs-of-credit-character-capital-capacity.html