FAQs

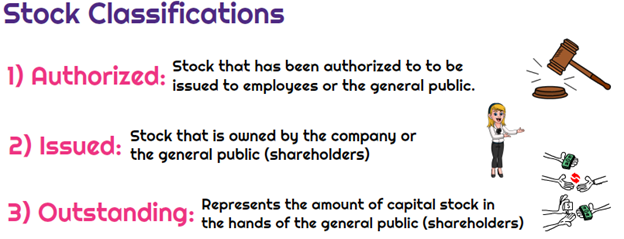

Generally, a company will not issue 100% of the authorized stock, so issued stock will be less than the authorized amount. Issued stock can be held by the company, held by employees, or held by the general public. Outstanding stock represents stock that is held by the general public.

What is the difference between authorized issued and outstanding stock? ›

They are “authorized” because they fall within the maximum number of shares a company can sell according to its corporate charter. They are “issued” because they have been sold. They are “outstanding” because they have been sold to the public (not to the owners or managers of the company).

What is the difference between issued and outstanding bonds? ›

The main difference between Issued and Outstanding Shares is that issued shares are the total shares a company has ever issued, including those held by the company itself, while outstanding shares are those currently held by investors, excluding any shares held by the company.

What does it mean when a stock is outstanding? ›

Outstanding stock is the authorized stock that the company has sold (issued) to and that shareholders currently hold. Commonly, the owners of outstanding stock receive dividend payments and have voting rights in shareholders' meetings. The company issues stock certificates to the owners of outstanding stock.

Can issued shares be more than outstanding? ›

The Outstanding shares are less than or equal to Issued shares. These cannot be more than issued shares but can be equivalent to them if there is no treasury stock.

What is the difference between issued shares and outstanding shares in Quizlet? ›

Issued Shares: those that a corporation has sold or otherwise transferred to stockholders. Outstanding Shares: the number of shares issued and that are in the hands of the stockholders.

How to calculate issued and outstanding shares? ›

The formula for calculating the shares outstanding consists of subtracting the shares repurchased from the total shares issued to date.

What is a treasury stock issued but not outstanding? ›

Treasury stock is a type of stock that has been reacquired by the issuing corporation. While held by the issuer, the stock is considered issued but not outstanding, and is not considered in measuring the value of outstanding common shares.

Are dividends paid on issued or outstanding shares? ›

The total amount of shares of a company's stock that have been issued and are currently held by investors are referred to as outstanding shares. These shares signify ownership in the business, give shareholders a say in corporate decisions, and entitle them to dividend payments made from the company's earnings.

What is the issued and outstanding basis? ›

“Issued and outstanding” means the number of shares actually issued by the company to shareholders. For example, your company may have “authorized” 10 million shares to be issued, but may have only “issued” 6 million of them, meaning there are another 4 million shares that are authorized to be issued at a later time.

Are More Shares Outstanding Good or Bad? Shares outstanding is just the amount of all the company's stock that's in the hands of its stockholders. By itself, it is not intrinsically good or bad.

What class is outstanding stock? ›

Class B shares

They carry fewer voting rights than other common shares, and a company issues these to insiders, such as officers and directors. Outstanding shares also include Class B shares in its calculation. These shares typically don't have a higher claim on dividends and assets than other common shares.

What is authorized stock? ›

Authorized stock refers to the maximum number of shares a publicly-traded company can issue, as specified in its articles of incorporation or charter. Those shares which have already been issued to the public, known as outstanding shares, make up some portion of a company's authorized stock.

What happens to outstanding shares? ›

A company's outstanding shares may change over time because of several reasons. These include changes that take place because of stock splits and reverse stock splits. There are also considerations to a company's outstanding shares if they're blue chips.

Can outstanding shares be sold? ›

While a company has a certain number of outstanding shares, not all of those shares are available for trading, since they may be closely held by some (large) investors. The shares that are available for public trading are called the company's stock float.

Are outstanding shares unissued? ›

Understanding Unissued Stock

Authorized stock is comprised of all stock that has been created, including shares up for sale to investors and issued to employees, as well as any shares not up for sale. The former is called outstanding stock, while the latter is referred to as unissued shares.

What is the difference between authorized issued and paid up capital? ›

The main difference between authorised capital and paid up capital is that authorised capital is the maximum amount of capital a company is legally permitted to raise by selling its shares, whereas paid up capital is the actual amount a company has received after selling its shares.

What is the difference between authorized issued and subscribed capital? ›

Key Takeaways. Share capital is the total of all funds raised by a company through the sale of equity to investors. Issued share capital is the value of shares actually held by investors. Subscribed share capital is the value of shares investors have promised to buy when they are released.

Is treasury stock issued and outstanding? ›

While held by the issuer, the stock is considered issued but not outstanding, and is not considered in measuring the value of outstanding common shares.

Is authorized stock the same as capital stock? ›

Capital stock, also known as authorized stock, refers to all common stock and preferred stock a corporation is legally allowed to issue. A corporation's charter establishes the amount of shares the corporation may issue, and the board of directors can either issue the maximum amount or retain a portion of the shares.